Home

About CRC

What We Do

WILLFUL

ESG

Contact

Client Login

|

2002

|

2003

|

2004

|

2005

|

2006

|

2007

|

2008

|

2009

|

2010-2011

|

2012

| |

| Credit Fund opens | Bilateral tranche of corporate loans for Dutch bank | Purchases entire Italian leasing securitization residual for €60 m | Buys subordinated tranches of SME RSTs for three different German lenders, all of whom will go on to be repeat customers

CRC agrees to the first cross-border investment in Mexican RMBS |

When fast amortization renders the first Belgian RST (2005) ineffective for the bank, CRC restructures to benefit both parties, validating CRC’s role as a reliable long-term partner

Seven RSTs, all but one under Basel II Basel II starts in Europe |

CRC establishes its first single investor fund for a public pension plan. The business model of managing several funds with parallel strategies will prove key to executing large transactions.

Six largely bilateral RSTs with European banks, investing a total of €565 m |

In the three weeks after Lehman’s collapse, CRC follows through on commitment to buy two bilateral RSTs, one for German and Austrian SME loans and one for seasoned German residential mortgages | Crisis notwithstanding, CRC invests in bilateral RSTs in Germany and Switzerland | Despite the Eurozone sovereign debt crisis, SME default rates across all CRC European deals fall from 2009 peak of 1.3 × base case to 1.0 × base case | Novel €200 m deal to hedge ABS trading book of European bank | |

|

2014

|

2015

|

2016

|

2017

|

2018

|

2019

|

2020

|

2021

|

2022

|

2023

| |

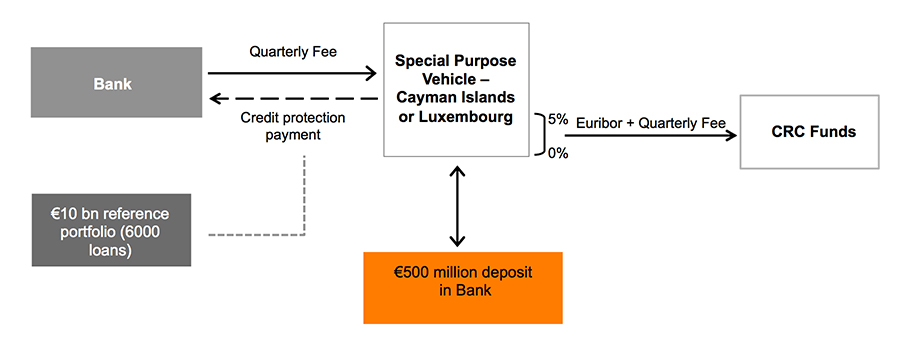

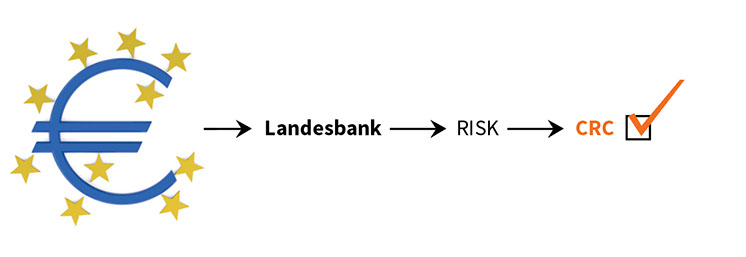

| Invests €450 m in second loss tranche tied to €11 bn pool for German Landesbank

First synthetic post-crisis Italian SME RST |

Upsizes 2014 Landesbank deal, adding €5 bn to reference portfolio | Sole equity sponsor of securitization of payroll deduction loans, the largest-ever Italian consumer ABS

In the 10 days after the Brexit referendum, CRC follows through on commitment to close four RSTs for banks in Italy, Austria and Germany, investing €525 m |

First ever SME RST for a Japanese bank

CRC launches liquid strategy: Bond Opportunity Trading Fund Official EU data suggests CRC accounted for 34% of synthetic RSTs from July 2014 – Dec 2016* |

For second consecutive year, invests over €900 m in RSTs | CRC launches the first ABS backed by pre-crisis assets to gain the EU’s “Simple, Transparent and Standardised” status

|

Invests €1.23 bn in a dozen RSTs, including first Italian pure renewables synthetic deal

|

Synthetic securitization of Monte dei Paschi’s Stage 2 loans named Structured Credit Investor’s Deal of the Year Opens office in Tokyo First ever RST for a Greek bank CRC funds acquire consumer lender Finsocial, with 650 employees across Colombia |

Synthetic securitization of Piraeus Bank’s performing shipping loans named Structured Credit Investor’s Deal of the Year RST for €8 bn portfolio referencing SMEs and Midcaps believed to be the largest-ever synthetic transaction in Italy |

For the third consecutive year, CRC funds invest over €1.5 bn in RSTs with European banks. In keeping with past trends, about one quarter of new deals are with first-time issuers. A bilateral RST for a Polish bank believed to be the largest ever in Central or Eastern Europe Invests in a novel RST to support loan growth for existing SME customers of an Italian bank |

| 2002 | Andrew Robertson Head Trader Oleg Gokhman Head of IT Andrew Leasor Marketing |

| 2004 | Takeshi Nakano Head of Asian Origination and Structuring |

| 2005 | Brad Golding Liquid Markets |

| 2006 | David Fitoussi Head of European Origination and Structuring |

| 2009 | Himesh Shah Origination and Structuring Joanna Kosek Origination and Structuring Dina Tserlyuk Operations Head |

| 2012 | Edmund Glaister Marketing |

| 2013 | Malik Chaabouni Trading |

| 2014 | Antony Wright CFO |

| 2019 | Sarah Shipton General Counsel |

| 2020 | Richard Dziurzynski Risk Management Head |

| GLOBAL HEAD COUNT: 66 |

| COUNTRY | STOCK MARKET SIZE (IN $BN) | INVESTABLE STOCK MARKET SIZE / GDP |

|---|---|---|

| US | 41,976 | 183% |

| Canada | 2,335 | 117% |

| Denmark | 463 | 117% |

| Sweden | 693 | 110% |

| Japan | 4,507 | 91% |

| UK | 2,840 | 89% |

| Finland | 235 | 79% |

| Netherlands | 718 | 71% |

| South Korea | 1,160 | 65% |

| France | 1,764 | 60% |

| India | 1,346 | 44% |

| Israel | 195 | 40% |

| Norway | 190 | 39% |

| Germany | 1,389 | 33% |

| Belgium | 189 | 31% |

| Spain | 427 | 30% |

| Ireland | 146 | 29% |

| Italy | 476 | 23% |

| Portugal | 37 | 15% |

| Greece | 32 | 15% |

| Austria | 62 | 13% |

| Poland | 59 | 9% |

| NEW YORK OFFICE 720 Fifth Ave., 13th Floor New York, NY 10019–4107 Telephone: +1 212 489 4350 Fax: +1 212 489 4355 | |

| LONDON OFFICE 11 Waterloo Place London, SW1Y 4AU Telephone: +44 (0)20 7227 4040 | |